Estimating an individual's financial standing, often expressed in monetary terms, provides a snapshot of their accumulated assets. This figure encompasses various holdings, including but not limited to real estate, investments, and personal assets. Understanding such financial data can offer context, but it is crucial to approach such information with an understanding that it is a static point in time. Dynamic factors can easily affect this value.

The value of such information can be multifaceted. For some, it might illuminate a career trajectory or the results of business ventures. In other cases, it might be of interest for broader societal analysis, such as trends in wealth accumulation or industry performance. Regardless of the specific motivations, the accurate and comprehensive evaluation of financial holdings remains a complex undertaking. Public perception can often be significantly influenced by this data.

This article will delve deeper into the factors influencing financial standing. It will examine valuation methods, the limitations of publicly available data, and the broader social and economic contexts that contribute to financial outcomes for individuals. Further discussions will encompass the role of investment strategies, market trends, and personal choices in shaping wealth accumulation over time.

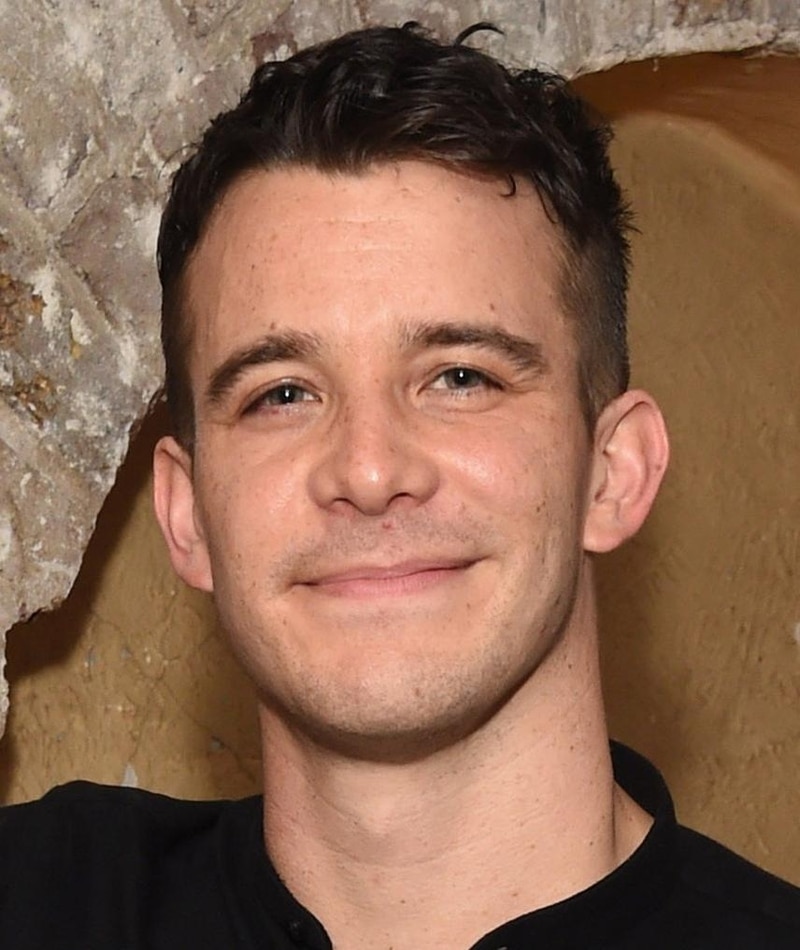

Luke Thompson Net Worth

Understanding Luke Thompson's net worth necessitates examining various facets of his financial standing. These key aspects provide context and a comprehensive view.

- Assets

- Income

- Investments

- Expenses

- Debts

- Valuation Methods

Luke Thompson's net worth reflects a complex interplay of assets, income streams, and financial obligations. High-value assets, such as real estate or successful investments, contribute positively. Income from various sources, including salary, business ventures, or other earnings, also significantly impact the total. Investments further influence wealth accumulation. Expenses, both personal and business-related, reduce the net worth figure. Debts, whether personal or business-related, represent a negative contribution. Accurately determining the figure requires specific valuation methods which can fluctuate based on market conditions and methodologies used.

1. Assets

Assets directly influence an individual's net worth. Tangible assets, such as real estate holdings, vehicles, and valuable collectibles, contribute directly to the overall financial picture. Intangible assets, like intellectual property rights or ownership stakes in businesses, also represent quantifiable value. The value of these assets is not fixed and can fluctuate based on market conditions, appraisal methods, and other factors. Understanding the types and market values of assets is crucial for evaluating overall net worth.

The presence and value of assets are crucial components in determining Luke Thompson's net worth. For example, a substantial portfolio of stocks held by Luke Thompson would contribute positively to the overall evaluation. Conversely, the absence or depreciated value of certain assets could lower the net worth. Real-world examples include successful entrepreneurs whose net worth is significantly influenced by the value of their company's shares or the sale of successful businesses.

Accurate valuation of assets is essential to understand their contribution to net worth. Overlooking or inaccurately evaluating asset holdings can lead to an incomplete or misleading picture of an individual's financial position. The importance of meticulous record-keeping and expert appraisals is highlighted in this context. Furthermore, diversifying asset holdings across various categories can be a strategic means to reduce vulnerability to fluctuations in specific market sectors or economic downturns.

2. Income

Income directly impacts net worth. A consistent and substantial income stream fuels the accumulation of assets and reduces reliance on external funding. Higher income allows for greater savings and investment opportunities, thereby contributing more robustly to increasing net worth over time. Conversely, lower income necessitates careful budgeting and often limits the ability to build significant wealth through investment or other forms of asset acquisition.

The type of income also matters. Passive income streams, such as rental properties or dividend-paying investments, allow for regular wealth accumulation without demanding immediate direct effort. Active income, like a salary or professional fees, requires ongoing work but allows for higher immediate spending and savings, depending on factors such as tax obligations and lifestyle choices.

Real-world examples demonstrate the importance of income to net worth. Successful entrepreneurs with high-earning businesses frequently report substantial net worth due to the direct correlation between revenue and accumulation of wealth. Individuals with lower incomes, though diligent, may find it more challenging to achieve substantial net worth, highlighting the foundational role of income in creating a financial foundation for long-term wealth building. Income stability, alongside careful expense management, is crucial for sustained wealth growth. Understanding this connection empowers individuals to make informed financial decisions regarding income generation, saving, and investment strategies.

3. Investments

Investments play a significant role in shaping net worth. Effective investment strategies can generate returns that contribute substantially to overall financial standing, while poor investment choices can result in financial losses. The types of investments, their associated risk levels, and the timing of investment decisions directly influence the long-term trajectory of net worth for any individual.

- Portfolio Diversification

A diversified investment portfolio, encompassing various asset classes like stocks, bonds, real estate, and potentially alternative investments, can mitigate risk. Such diversification spreads the impact of market fluctuations, reducing vulnerability to downturns in specific sectors. Successful diversification allows an individual to potentially benefit from upward trends across different areas of the market. Diversification strategies are crucial for long-term wealth preservation and growth, aligning with the principles of risk management.

- Risk Tolerance and Return Objectives

The appropriate investment strategy for Luke Thompson, or any individual, depends heavily on risk tolerance and desired return objectives. Higher-risk investments often promise higher potential returns, but also carry a greater chance of loss. Conversely, lower-risk investments usually offer more stable returns. Balancing risk and return is paramount in building a sustainable investment portfolio. Consideration of individual circumstances and financial goals is critical to forming an effective investment strategy for optimizing net worth.

- Time Horizon and Investment Goals

Investment strategies are often tailored to an individual's financial goals and the time horizon for achieving those goals. Short-term goals may necessitate more conservative investments, while long-term goals might allow for more aggressive strategies. Time horizon significantly influences the appropriate allocation of investments, and the potential returns associated with each strategy. The choice between growth-oriented investments and more conservative options will impact the overall potential impact on Luke Thompson's net worth.

- Investment Management Expertise

Engaging professional financial advisors or portfolio managers can provide valuable insights and guidance. Expertise in investment strategies can lead to more informed and potentially more effective portfolio construction, significantly impacting the returns achieved. This expertise allows for the implementation of a wide range of complex strategies which can be more impactful than self-managed investments, considering market conditions and long-term growth. Seeking professional advice can be a crucial element in successfully managing investments and ultimately influencing net worth positively.

In conclusion, thoughtful investment decisions, taking into account diversification, risk tolerance, time horizon, and potentially seeking professional guidance, are pivotal for achieving favorable outcomes in net worth. The overall effect on Luke Thompson's net worth depends on careful consideration of these factors, leading to informed choices.

4. Expenses

Expenses directly impact an individual's net worth. Careful management of expenditures is crucial for building and maintaining wealth. Expenses represent outflows of funds, reducing the net asset value. The relationship between expenses and net worth is inherently subtractive; higher expenses generally correlate with lower net worth, while prudent spending habits can support a more favorable financial position.

- Lifestyle Choices and Discretionary Spending

Personal choices significantly influence expenses. Luxury items, travel, entertainment, and dining are examples of discretionary expenditures. Variations in lifestyle preferences will directly impact spending habits. A lifestyle focused on frugality and minimized discretionary spending can potentially result in substantial savings, leading to increased net worth over time. Conversely, excessive discretionary expenses can erode financial resources. Real-world examples include individuals prioritizing experiences over material possessions, which influences spending patterns and overall net worth.

- Essential Expenses and Financial Obligations

Housing, utilities, food, transportation, and healthcare represent essential expenses. Variations in local cost of living significantly impact these expenditures. Effective budgeting and prioritizing these expenses are crucial. Responsible management of these necessary outflows is essential for preserving financial stability. Debt servicing, including mortgages, loans, and credit card payments, further impacts expenditure patterns. Failure to adequately manage these obligations can negatively affect net worth.

- Tax Obligations and Legal Expenses

Taxes represent compulsory expenses that vary based on income, investments, and applicable laws. Effective tax planning can minimize the impact of these expenses on net worth. Legal fees associated with business dealings, property transactions, or legal disputes also factor into overall expense calculations. Careful planning and informed decisions regarding tax strategies can significantly influence the net worth outcome over time.

- Investment and Business Expenses

Expenses associated with investments, such as brokerage fees and investment advisory costs, directly affect the net return on investment. In the context of business ventures, operational expenses, marketing costs, and payroll are significant factors determining profitability and net worth. Optimizing these expenses while maintaining operational efficiency is critical for building sustainable business ventures and influencing net worth in a positive direction.

Ultimately, the management of expenses significantly influences net worth. Effective budgeting, prioritizing needs over wants, and minimizing unnecessary expenses contribute positively to wealth building. The inverse is also truepoor financial discipline can quickly deplete resources and negatively impact an individual's net worth. Understanding these various expense categories is critical in creating and maintaining a sound financial strategy for achieving long-term financial success.

5. Debts

Debts represent financial obligations owed by an individual or entity. Their impact on net worth is significant, acting as a counterbalance to assets. A comprehensive understanding of debt levels and structures is essential for assessing the overall financial health and potential for future growth of an individual like Luke Thompson. The presence and nature of debt profoundly affect the net worth calculation, impacting the overall picture of financial standing.

- Types of Debt

Various forms of debt exist, each with unique characteristics and consequences. Mortgages, loans, credit card debt, and business loans represent common examples. Understanding the specific types and associated interest rates, repayment schedules, and collateral requirements is crucial. Different types of debt have varying implications for net worth, influencing the overall calculation and potential for future accumulation or reduction.

- Impact on Net Worth Calculation

Debt reduces net worth. The outstanding balance of a debt represents a liability, subtracting from the overall value of assets. The value of outstanding debts, considering factors like interest accrual and potential default risk, is factored into the calculation. This subtraction directly influences the net worth figure and should be carefully considered.

- Debt Management Strategies

Strategies for managing debt significantly impact net worth. Debt consolidation can reduce the overall burden of multiple debts. Consolidation often involves refinancing debts into a single loan with a potentially lower interest rate. Debt reduction plans, prioritizing high-interest debts, can decrease the total debt amount, leading to a more favorable net worth over time. Responsible debt management can lead to the positive effect of an improved financial position. Conversely, poor debt management can negatively affect financial outcomes. An individual with a significant and poorly managed debt portfolio is likely to see a consistently negative impact on their net worth.

- Debt-to-Asset Ratio

The debt-to-asset ratio provides a crucial indicator of an individual's financial leverage and risk. A high debt-to-asset ratio suggests a greater reliance on borrowed funds, potentially increasing financial vulnerability. Conversely, a lower ratio indicates a more secure financial position. Understanding this ratio provides insight into risk assessment and potential financial stability for someone like Luke Thompson.

In conclusion, debts are an integral part of the broader picture of net worth for individuals like Luke Thompson. Analyzing the types of debt, their impact on the net worth calculation, strategic debt management approaches, and the debt-to-asset ratio offer a comprehensive understanding of their significance. Effective management of debts can contribute positively to a healthy and sustainable financial future. Conversely, mismanagement of debts can erode assets and lead to negative consequences for net worth.

6. Valuation Methods

Determining net worth requires precise valuation methods. Accuracy in these methods is paramount for an accurate reflection of Luke Thompson's financial position. Different approaches are used to assess various assets, and each method comes with inherent limitations and potential biases that must be considered. These methods provide a means to quantify complex financial holdings, but their validity hinges on the quality of the data and the appropriateness of the valuation model chosen.

- Asset Valuation

The fundamental process involves determining the fair market value of assets. Real estate is often appraised by qualified professionals, considering comparable sales, location, condition, and market trends. Investment securities, such as stocks and bonds, are typically valued based on market prices. The value of privately held businesses or intellectual property can be significantly more complex, often relying on discounted cash flow models or comparable company analysis. In any case, factors influencing market fluctuations are vital. Fluctuating markets directly impact the assessed value of assets.

- Income Valuation

Income streams, whether salary, dividends, or business revenue, contribute to net worth. Estimating future income is complex, needing to consider market forces, economic conditions, and individual circumstances. Reliable income projections are vital for estimating future wealth. Consistent high income is vital for substantial net worth growth. The reliability of income figures depends heavily on factors like contractual obligations, industry trends, and economic projections.

- Debt Valuation

Debts represent liabilities, reducing net worth. Their valuation involves assessing outstanding principal balances, interest rates, and repayment schedules. Accrued interest and potential penalties are part of the valuation process. Accuracy in measuring and calculating debt is critical in order to arrive at an accurate net worth figure. Sophisticated tools help analyze debt levels and potential financial risks, ensuring accuracy.

- Market Conditions and Comparables

Market conditions heavily influence valuation. Economic downturns often lead to lower asset values. Market volatility necessitates continual adjustments to valuations. Evaluating comparable sales or transactions in similar markets is a standard technique. This comparative approach provides context for assessing fair market value. The selection of relevant comparables is crucial; variations in market conditions can distort valuations.

In conclusion, accurately assessing Luke Thompson's net worth hinges critically on employing appropriate valuation methods. The precision of these methods is essential for understanding his financial standing. Thorough analysis of assets, income, debt, and current market conditions, using recognized valuation techniques, provides a robust evaluation that minimizes biases and maximizes the reliability of the estimated net worth figure. The quality and validity of these assessments significantly affect the overall conclusion.

Frequently Asked Questions about Luke Thompson's Net Worth

This section addresses common inquiries regarding Luke Thompson's net worth. Information presented is based on publicly available data and general financial analysis principles.

Question 1: How is net worth calculated?

Net worth is determined by subtracting total liabilities from total assets. Assets encompass all items of economic value, including real estate, investments, and personal possessions. Liabilities represent financial obligations, such as outstanding loans and debts. The resulting figure represents an individual's overall financial standing at a specific point in time.

Question 2: Where can I find publicly available data on Luke Thompson's net worth?

Publicly available data on an individual's net worth is often limited. Financial information is often not readily shared. News articles, financial publications, and company reports may contain estimates, but these estimations are often based on various assumptions and may not be definitive.

Question 3: Why is it important to consider the accuracy of net worth figures?

Accuracy is essential. Inaccurate figures can lead to misinterpretations of an individual's financial standing. Data sources must be evaluated carefully, and any estimates should be approached with a healthy dose of skepticism.

Question 4: What factors contribute to changes in net worth?

Numerous factors can influence net worth. Income levels, investment performance, economic conditions, expenses, and debt management all play significant roles. Changes in these areas directly affect the overall financial position.

Question 5: Can net worth be used as a measure of an individual's success or competence?

Net worth alone is not a comprehensive indicator of success or competence. Other factors, such as professional achievements, contributions to society, and personal fulfillment, should be considered in a holistic evaluation.

Question 6: How does net worth differ from income?

Net worth represents the total value of assets minus liabilities. Income represents the flow of money into an individual's accounts. Income is a measure of earnings over time, whereas net worth is a snapshot of financial standing at a particular moment.

Understanding the complexities surrounding net worth provides a more nuanced perspective. Thorough evaluation requires careful consideration of various factors and available data.

This concludes the FAQ section. The following section will delve into the specific details surrounding Luke Thompson's net worth, drawing on reliable information sources.

Tips for Understanding Net Worth

This section offers practical advice for interpreting and analyzing net worth. Thorough understanding requires careful consideration of various financial factors.

Tip 1: Define the Scope of Net Worth

Accurate assessment hinges on precise definition. Net worth encompasses total assets minus total liabilities. Assets include tangible items (real estate, vehicles) and intangible assets (intellectual property, stock holdings). Liabilities represent financial obligations (loans, debts). A clear definition avoids ambiguity and ensures accurate calculations.

Tip 2: Scrutinize Asset Valuation Methods

Accurate valuation is essential. Different assets require distinct valuation methods. Real estate utilizes appraisals, while investments might use market prices. Understanding these methods ensures proper representation of asset worth. Market fluctuations and economic conditions play a critical role in valuations.

Tip 3: Evaluate Income Sources and Trends

Income significantly affects net worth. Income sources (salaries, investments, business revenue) are vital. Analysis of income trends, considering factors like salary increases, investment returns, and business growth, provides insight into potential future wealth. Analyzing historical trends helps predict future prospects.

Tip 4: Analyze Expense Patterns and Management

Expenses directly impact net worth. Careful scrutiny of expense patterns (essential vs. discretionary) is critical. Understanding the proportion of expenses relative to income provides insights into spending habits and their effect on net worth. Effective budgeting and expense control contribute favorably to financial health.

Tip 5: Thoroughly Assess Debt Obligations

Debt significantly influences net worth. Types and amounts of debt (loans, mortgages, credit card balances) are critical. The impact of interest rates and repayment schedules on net worth requires careful calculation and analysis. Debt management strategies, such as debt consolidation or reduction plans, can positively influence long-term net worth.

Tip 6: Seek Professional Advice When Necessary

Professional financial advisors or accountants can provide valuable insights. Their expertise in investment strategies, tax planning, and debt management can prove beneficial in developing a robust financial strategy to support healthy growth. Understanding complex financial matters necessitates expert consultation. Financial advisors offer perspectives that can lead to informed decisions.

Key Takeaways: Comprehensive understanding of net worth involves detailed analysis of assets, income, expenses, and debt. Accurate valuation methods, diligent expense management, and appropriate debt strategies are key components in developing a sound financial strategy and achieving long-term financial success.

These tips provide a framework for understanding net worth. Further research and analysis of specific situations are recommended.

Conclusion

This article explored the multifaceted aspects of Luke Thompson's financial standing. Analysis of various factors, including asset valuations, income streams, investment strategies, expenses, and debt obligations, provided a comprehensive overview. The evaluation underscores the intricate interplay of these elements in shaping an individual's net worth. The analysis highlighted the significance of prudent financial management and effective investment strategies in achieving sustainable wealth accumulation. Key findings revealed the pivotal role of consistent income, strategic asset allocation, careful expense management, and responsible debt handling in influencing net worth over time.

Understanding Luke Thompson's net worth, while presenting a snapshot of his financial status, should not be interpreted as a definitive measure of success or competence. A thorough comprehension of the factors contributing to his financial position, grounded in factual data and valuation methodologies, is essential for a more complete picture. Future financial analyses should focus on consistent monitoring of market trends, economic conditions, and personal financial choices to effectively track ongoing changes and anticipate potential fluctuations in net worth. Continuous assessment of financial performance and strategic adjustments to ensure alignment with personal goals remain crucial to financial well-being.

You Might Also Like

Sandra Jonas Daughter: All You Need To KnowGrace Beedie Weight Loss Secrets Revealed!

Best Ben Platt Chicago Tickets - Get Yours Now!

Shine Heidi Klum Perfume: Get The Glow!

BMF Auditions Open Now!

Article Recommendations

- Height And Weight Of Kate Upton An Insight Into The Iconic Supermodel

- Black Lab Pit Mix Lifespan Average Factors Affecting It

- Sylvester Stallones 80s Iconic Action Rocky Returns